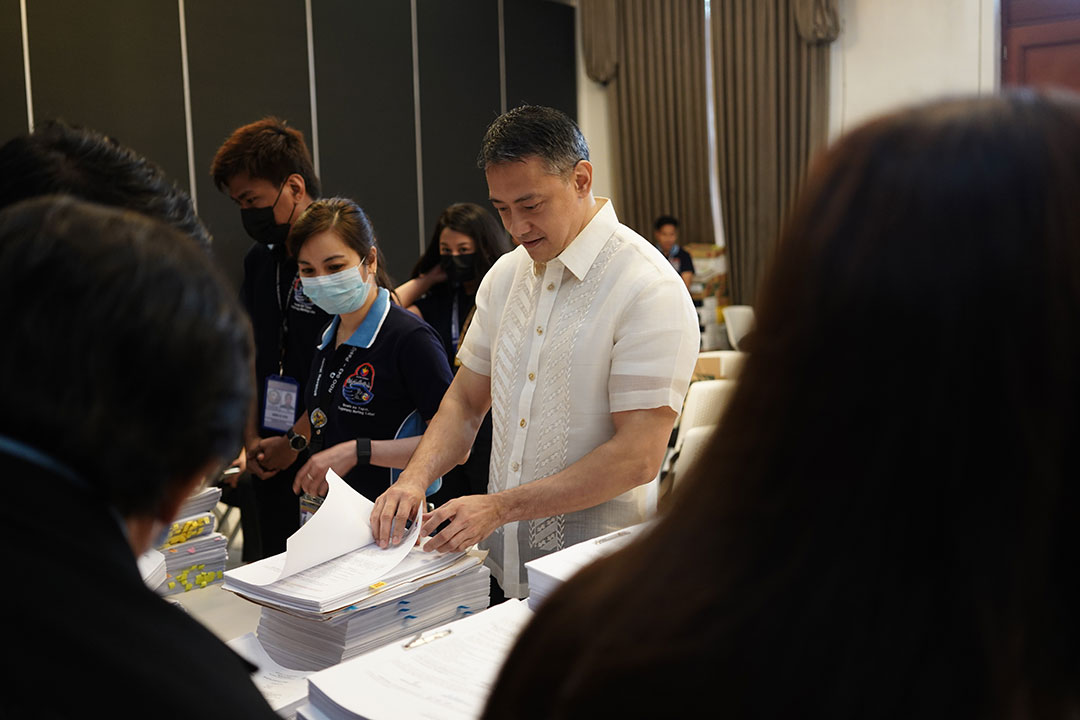

THE Bureau of Internal Revenue (BIR) on Thursday filed criminal complaints against several corporations, officers, and accountants for allegedly using ghost receipts to evade P1.4 billion in taxes.

The 23 cases, filed before the Department of Justice (DoJ), targeted 23 corporations, 56 corporate officers, and 17 accountants in the construction, manufacturing, food, electronics, entertainment, marketing, and retail industries.

“They obtained multiple suspicious purchases from ghost corporations or those corporations that exist only on paper but without actual business operations, employees, or tangible assets,” BIR Commissioner Romeo D. Lumagui, Jr. said in a statement.

“These suspicious purchases were linked to ghost receipts which have no actual transactions and were only used to create the appearance of legitimate business expenses/purchases to lower tax payments,” he added.

Justice Undersecretary Jesse Hermogenes T. Andres said the scheme usually involves companies inflating their expenses with fake transactions to cut their tax liability.

“The scheme is normally to reduce the tax liability by adding up expenses to the gross revenue which are not really real expenses. So, the tax liability will be less,” Mr. Andres told reporters during a briefing at the DoJ in Manila.

“But the supporting receipts for these expenses are the fraudulent or fake receipts coming from these companies that are really just put up for the purpose of supplying these fraudulent expense receipts.”

Mr. Lumagui said the respondents will be allowed to submit evidence disproving their links to ghost receipts in a separate audit.

“We also give them the opportunity to prove that those are not really ghost receipts. So aside from the due process that the Department of Justice will carry out, we also have our own due process through auditing,” the commissioner said.

“And ultimately, they haven’t been able to prove anything — they haven’t shown us that the amount stated on the receipt is the same amount they actually paid to the corporation that issued the receipt. So it’s clearly a case of tax evasion,” he added.

This initiative forms part of the BIR’s Run After Fake Transactions (RAFT) program, which targets businesses and individuals suspected of engaging in the sale or purchase of fraudulent receipts, Mr. Lumagui noted.

Earlier this year, the BIR filed criminal cases against a well-known cosmetics company and a shoe company for tax evasion from fake receipts. The DoJ later indicted them after finding probable cause.

Mr. Lumagui said ghost receipts account for a majority of the government’s nearly 40% value-added tax gap.

He urged those who used ghost receipts to stop evading taxes and resorting to illegal tactics as it deprives legitimate businesses that comply with tax laws of a fair playing field.

“If you’re expecting the BIR to stop pursuing this issue, or if you’re counting on finding some illegal workaround to get out of it, we’ve already shown that those tactics won’t work anymore,” Mr. Lumagui said in Filipino.

“This is also why we’re focusing on this: because legitimate businesses that do pay their taxes properly are the ones suffering. Through our efforts, we are simply leveling the playing field to ensure that everyone pays the correct taxes. So, let’s stop this practice, and let it be clear that we will not stop going after those involved.” — Katherine K. Chan