Yesterday, President Ferdinand R. Marcos, Jr. delivered his fourth State of the Nation Address (SONA). Since this column was submitted several hours before the SONA was held at 4 p.m. Monday, I have looked back on some of the President’s pronouncements in his last three SONAs, focusing on public finance and fiscal economics.

“Disbursements for 2022 to 2023 will be maintained at… P4.955 trillion and P5.086 trillion, respectively… P5.402 trillion or 20.7% of our GDP in 2024 to P7.712 trillion or 20.6% of GDP in 2028.” — First SONA, July 25, 2022

“The essential tax measures under our Medium-Term Fiscal Framework, such as… excise tax on single-use plastics, VAT on digital services, rationalization of mining fiscal regime, motor vehicle user’s charge/road user’s tax, military and uniformed personnel pension.” — Second SONA, July 24, 2023

“Tax and non-tax revenue collection has also become more efficient, in pace with our rejuvenated economy. Notably, for the past two years, our GOCCs have remitted dividends to the National Government with a combined tally exceeding their contributions in 2022.” — Third SONA, July 22, 2024

I checked on the fiscal performance from 2022-2024, then the fiscal targets for 2025-2028. Actual disbursements were P5.16 trillion in 2022, P5.34 trillion in 2023, and P5.92 trillion in 2024. The disbursement targets are P6.08 trillion in 2025, then P6.63 trillion in 2026, P6.97 trillion in 2027 and P7.47 trillion in 2028.

This means that government has been overspending or overshooting its targets in disbursements since 2022 that will continue until 2028.

No revenue targets were mentioned in SONA 2022 to 2024. The numbers on revenues from the Bureau of the Treasury (BTr) and Development Budget Coordination Committee (DBCC) are: P3.54 trillion in 2022, P4.42 trillion in 2024, P4.98 trillion in 2026, and P5.91 trillion in 2028.

The budget deficits are as follows: P1.61 trillion in 2022 (from P1.67 trillion in 2021), P1.51 trillion in 2024, P1.65 trillion in 2026, and P1.55 trillion in 2028.

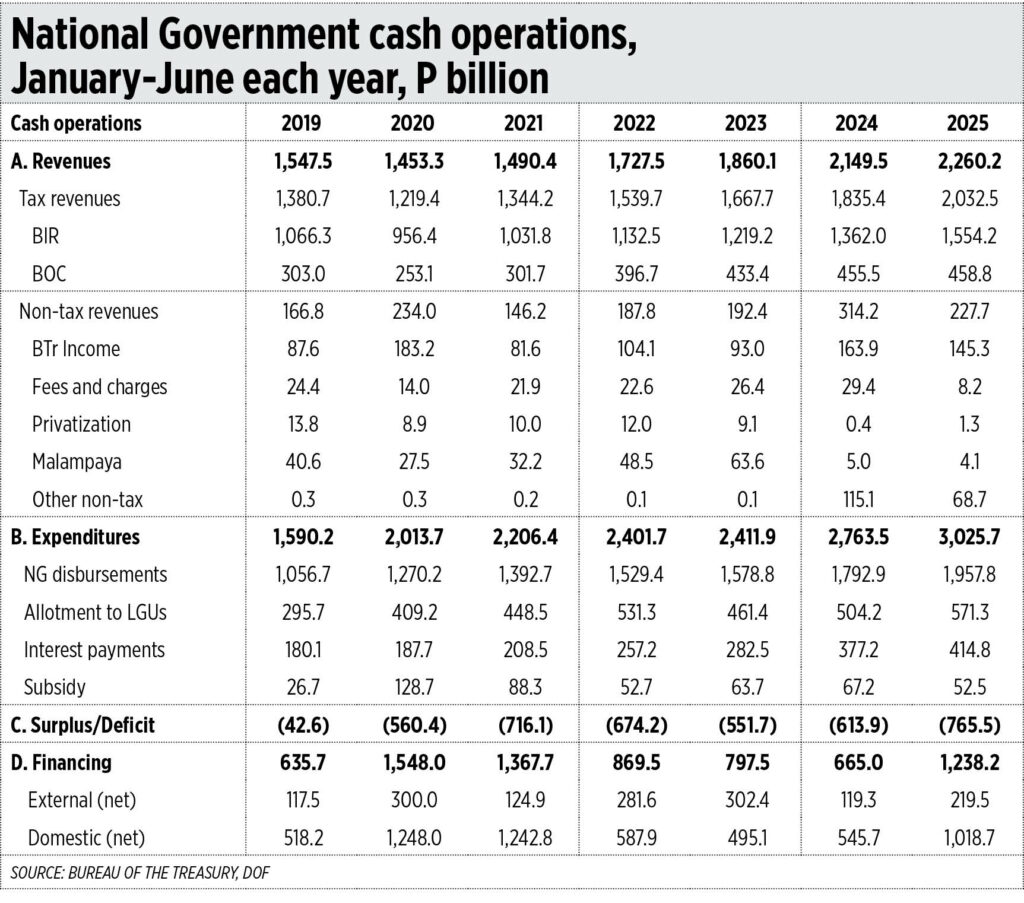

Last week the BTr released the cash operations report for June 2025. I compared the cumulative January-June data with previous years and saw some good and bad news.

The good news is that on the revenue side, the “Other non-tax” revenue that refers mainly to higher mandatory remittance of government-owned and -controlled corporations (GOCCs), has significantly jumped from almost zero in previous years to P115 billion in 2024 and P69 billion in 2025. This is better called the “Recto effect.” Finance Secretary Ralph G. Recto ordered the GOCCs to raise their mandatory remittances to the Treasury from 50% to 75% and it went well.

The bad news comes from the revenue side. The Bureau of Customs (BoC) has seen poor collections in 2024 and 2025, nearly as flat as the 2023 level. New BoC Commissioner Ariel Nepomuceno has a heavy burden — to significantly raise the customs collections, mainly by addressing the considerable levels of smuggling and illicit trade in many sectors, from tobacco to petroleum to gadgets.

The bigger piece of bad news is on the spending side. Both National Government (NG) and local government units (LGUs) spending are jumping up simultaneously, instead of NG spending rising moderately if not remaining flat as more functions and revenues go to the LGUs.

The result is inevitable — the budget deficit in 2025 is back to 2020 and 2021 levels during the time the lockdown dictatorship led to a huge decline in revenues while expenditures for subsidies jumped high (see the table).

Budget Secretary Amenah F. Pangandaman has pushed measures for spending transparency and responsibility, like the Open Government Partnership (OGP) and the Government Optimization Act, formerly the National Government Rightsizing Program bill, that became a law.

The big problem in fiscal economics is often on the spending side and not so much on the revenue side. As a clear example — in April the various agencies submitted a total budget wish list of P10 trillion for 2026, even if the DBCC expenditures target is only P6.6 trillion to control the deficit and borrowings.

There are two specific expenditures that I want to mention — infrastructure and flood control projects of the Department of Public Works and Highways (DPWH), and the military and uniformed personnel (MUP) pension.

The Philippines, Luzon in particular, has just experienced 12 straight days of rain, from July 17 to July 28, when this column went to press. Heavy rains occurred on July 18 to 25, Friday to Friday, that led to a “classless society” — no classes (for elementary to college levels) were held for six days straight. There was a lot of flooding in many cities, municipalities, and barangays. Meaning that of all the trillion plus pesos worth of flood control projects by the DPWH, many are ineffective or perhaps non-existent. Big reforms and accountability are needed here.

The southwest monsoon or “habagat” plus three consecutive storms over the past two weeks have caused 30 deaths and affected 5.57 million individuals from 1.54 million families across 6,053 villages in 17 regions. The data is from the National Disaster Risk Reduction and Management Council or NDRRMC.

The MUP pension fund, which averaged P120 billion/year from 2021-2024, increased to P144.7 billion in 2025, and is targeted at P217 billion in 2026, a 50% increase in just one year. This is patent abuse of taxpayers. Those personnel do not contribute to their own pensions, they take home their salaries with no pension deductions unlike government doctors and nurses, government lawyers and engineers, government teachers and professors, and others who contribute monthly for their future pension.

The President had already mentioned the need for reforms of the MUP pension in his SONA 2023. There should be follow-up measures to reform this anti-taxpayers policy.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.