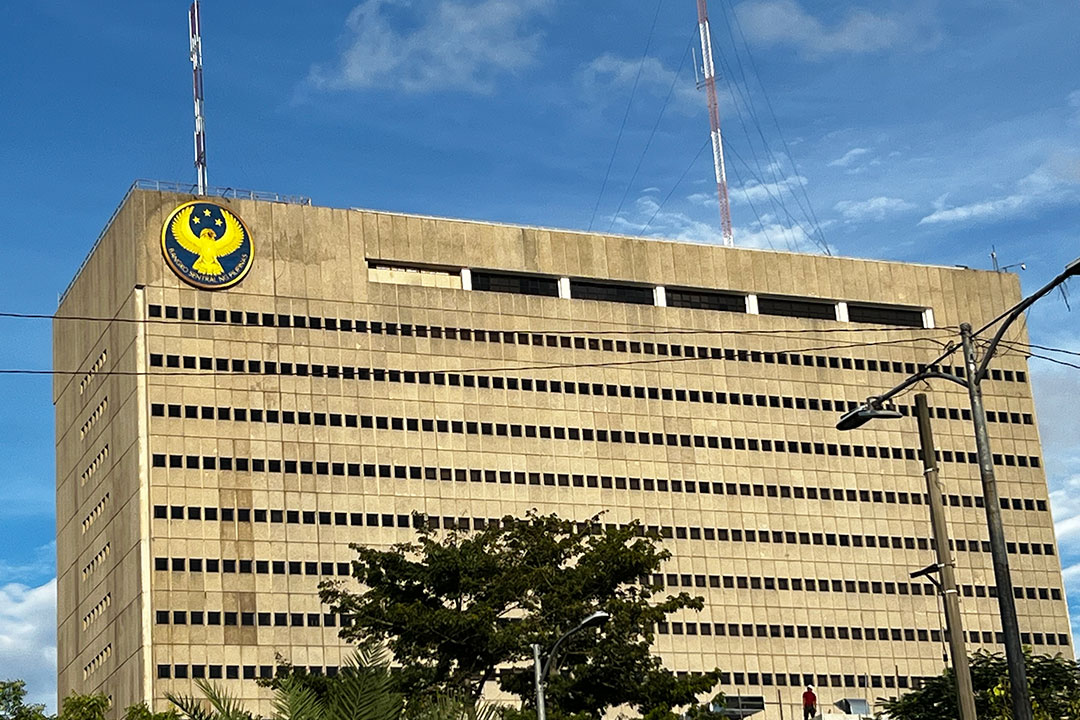

A EUROPE-BASED digital bank is applying for a local digital banking license, the Bangko Sentral ng Pilipinas (BSP) said.

BSP Deputy Governor Chuchi G. Fonacier said one digital bank has already completed the requirements for the application.

“There’s only one,” she told reporters on Tuesday.

Ms. Fonacier said other digital banks are interested in applying but have yet to complete the paperwork.

“There are those applying but are in the process of completing the requirements. That’s why we’re not at liberty to disclose. One already did the paperwork, but there are some that are still lacking in the documentary requirements,” she said.

The BSP in January lifted a three-year moratorium on digital banking licenses, allowing four more players to operate in the country. These can either be new applicants or banks that will convert their existing license to a digital one.

There are six digital banks in the country.

The BSP said applicants must “bring something new to the table” and offer innovative products that will cater to underserved and untapped markets.

Ms. Fonacier said the Europe-based bank has proposals to tap underserved segments.

She added the applicant uses artificial intelligence (AI) and gives their users access to transactional and credit data.

“That’s the challenge with data. How do you build the data on one person? This bank has a way to build something like that… Of course, AI also has a role. But they have this solution where you can easily gather information,” she said.

Ms. Fonacier also said that while only two active digital banks are profitable, the industry is on track to breaking even.

“It’s understandable, right? If you’re a startup, you go through that process. It’s not right away… You’re still establishing your presence… The prospects in the Philippines that we’re seeing are better compared with the other jurisdictions that have six players,” she said.

The six digital banks operating in the Philippines are Tonik Digital Bank, Inc.; GoTyme Bank of the Gokongwei group and Singapore-based Tyme; Maya Bank of Voyager Innovations, Inc.; Overseas Filipino Bank, a subsidiary of Land Bank of the Philippines; UNObank of DigibankASIA Pte. Ltd.; and UnionDigital Bank of Union Bank of the Philippines, Inc.

Preliminary data from the BSP showed that the digital banking sector posted a P1.04-billion net loss as of end-March.

The digital banking industry has been in the red since the BSP began consolidating data from the sector starting March 2023. — Aaron Michael C. Sy